"We aim to become the trusted partners you can always rely on"

Capital Allowances

Capital Allowances

What are Capital Allowances?

When you buy or improve a commercial property, HMRC will allow you to offset some of the expenditure against your trading income. Your accountant will usually deal with the obvious expenditure such as refurbishment costs, but there are also reliefs available for the items that are integral to a property and at KLAS we find these items such as lifts, lift shafts, lighting systems, heating systems, air-conditioning, and even items such as locks and ironmongery. A specialist survey will identify and quantify these items and the relief available.

Capital Allowances – How will this benefit me?

If you own or occupy a commercial property you may be eligible for tax relief in the form of Capital Allowances, typically 25% of the property purchase price. This allowance isn’t a tax loophole; it is your stator right to claim. Allowances can be offset against the trading income that they derive from. Providing you still own the property, claims can be retrospective from the date of ownership and you can offset against profits going back 2 years which may result in a tax refund. You can also carry forwards any remaining balance to be offset against future trading profits.

Is my property eligible?

There are an estimated two million properties in the UK that do qualify: Your property must be classified as commercial property (i.e. hotel, care home, office, factory, warehouse etc.)

The property must not be held in a pension fund; by the government; by a charity, treated as stock, or held by a not for profit organisation.

The property must be owned by a UK taxpayer (individual, partnership, LLP, PLC, or Limited company)

Typical eligible property types:

The property must not be held in a pension fund; by the government; by a charity, treated as stock, or held by a not for profit organisation.

The property must be owned by a UK taxpayer (individual, partnership, LLP, PLC, or Limited company)

Typical eligible property types:

- Care Homes

- Industrial Units

- Retail Units and shopping centres

- Car showrooms

- Hotels and restaurants

- Offices

- Petrol stations

- Caravan/holiday parks

- Children’s nurseries

- Public houses

Case Studies

Hotel

Our client, a Hotelier, purchased a new Hotel for £5.2m. We undertook a detailed survey of the property and identified qualifying capital allowances in the region of £1.75m including pool plant and machinery, integral features and energy saving plant which qualified for enhanced capital allowances.

Our client, a Hotelier, purchased a new Hotel for £5.2m. We undertook a detailed survey of the property and identified qualifying capital allowances in the region of £1.75m including pool plant and machinery, integral features and energy saving plant which qualified for enhanced capital allowances.

The tax savings identified quoted to an initial first year tax saving of £83,000. We also identified a further £2.7m of industrial building allowances, which led to additional first year tax saving of £22,500.

Offices

Our client, a firm of Solicitors, had previously purchased their offices for £900,000. We undertook a detailed survey of the property and identified qualifying capital allowances in the region of £143,000 which included plant, machinery, integral fixtures, heating installations and fire safety measures.

Our client, a firm of Solicitors, had previously purchased their offices for £900,000. We undertook a detailed survey of the property and identified qualifying capital allowances in the region of £143,000 which included plant, machinery, integral fixtures, heating installations and fire safety measures.

The tax savings identified equated to a first year tax saving of £40,000.

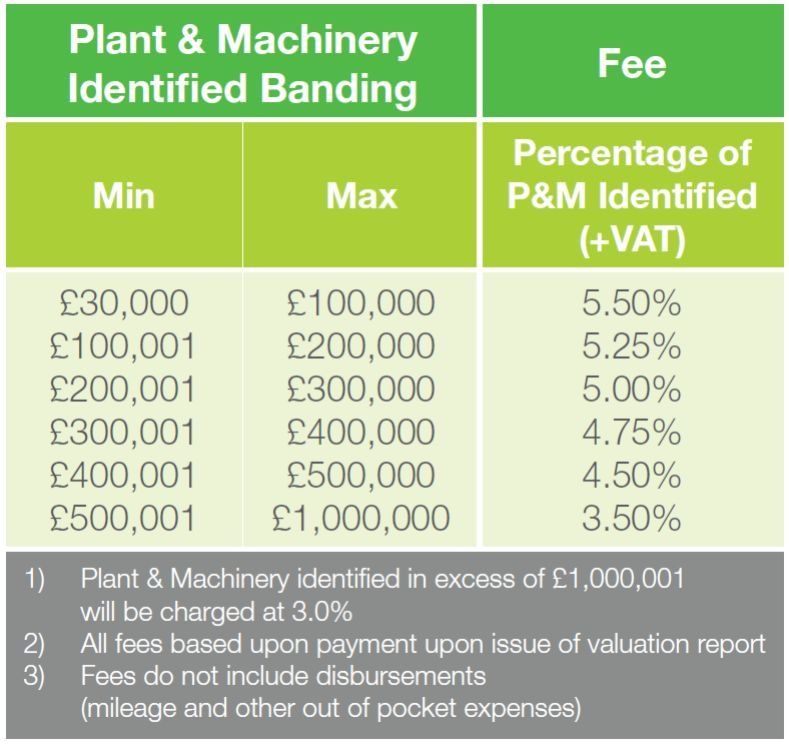

Typical fees based on the total amount of Capital Allowances identified are:

If you would like to arrange a free no obligation chat, click here. For more information on how we can help, email us on info@klasltd.com

or call 0151 459 1300.

GET IN TOUCH

“The KLAS team were brilliant, and they managed to obtain a substantial tax refund, this I would never have achieved had it not been for the knowledge and expertise KLAS offer to their clients”